Not known Details About Paypal Business Loan

Wiki Article

How Paypal Business Loan can Save You Time, Stress, and Money.

Table of ContentsAll about Paypal Business LoanGetting My Paypal Business Loan To WorkThe 30-Second Trick For Paypal Business LoanSome Ideas on Paypal Business Loan You Should KnowThe Definitive Guide for Paypal Business LoanIndicators on Paypal Business Loan You Need To KnowNot known Facts About Paypal Business LoanExamine This Report about Paypal Business LoanThe Best Guide To Paypal Business Loan

You will be representing your business and mentioning your instance as to why the loan provider need to consider you worthy of a car loan. This takes some preparation on your part. You will need to have a strong service plan as well as an in-depth explanation of exactly how you will certainly use the cash. It likewise helps to include just how this cash would assist you expand your organization's annual earnings.Do not fail to remember to dress properly and to perfect your lend a hand individual and also in composing, just in situation they call for an on the internet financing application. The large wigs in the banking industry wish to see numbers, yet they are human (primarily) and can be won over by a good individuality and method with words.

Facts About Paypal Business Loan Uncovered

If you have a cash money flow of $5000 per month as well as your financing payments would be $2500, your DSCR is 2 due to the fact that your financing payment is half your revenue. Unnecessary to claim, the greater your DSCR, the much better your opportunities of getting the funding.

The Of Paypal Business Loan

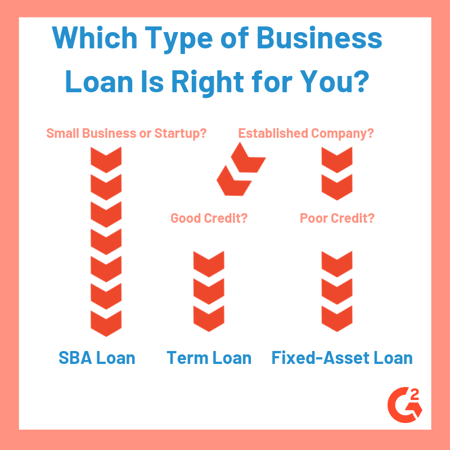

Not just does this program that you think sufficient in your own company to place your properties on the line, yet often business does not have sufficient collateral to cover the funding quantity. If you want others to risk their finances for your business, you should prepare to risk your own. PayPal Business Loan.This is especially real when you are looking at the different kinds of financings available to you. Below are several of one of the most usual kinds of tiny organization car loans: The united state Small Organization Administration produced this funding program to aid develop more organization opportunities in the country and, consequently, advertise a much better economy.

5 Simple Techniques For Paypal Business Loan

federal government backs the car loans, so the terms and rates are normally great for small company owners. To apply for an SBA car loan, you require to see their web site and adhere to the directions. You'll discover the majority of the needed forms on the site, however you will certainly require to locate an SBA-approved lender to complete the application procedure. These fundings are normally secured by business properties. A working funding financing is a short-term lending to help the service remain afloat when resources is brief.You require great site to be conscious that you will be anticipated to pay the lending back in full instead quickly (usually much less than 12 months). This kind of car loan resembles a personal credit rating card, however it is available in the type of a different checking account for your company.

The Single Strategy To Use For Paypal Business Loan

It is very adaptable yet typically features a higher rates of interest. When searching for a tiny business funding, there are a few different things that you ought to keep your eyes and ears open for. Let's damage down these aspects of a finance and also exactly how the different kinds of financings rate for these aspects.The longer you have to wait to get your funding, the even worse your economic situation can get. If you remain in alarming demand of money to maintain your organization afloat, the rate of funding must be one of the top concerns in your selection of financing. The fastest approach of company funding is a merchant cash loan.

How Paypal Business Loan can Save You Time, Stress, and Money.

As superb of a deal as SBA loans are, this is where they fall short. SBA financings can take months to process.

Some Ideas on Paypal Business Loan You Need To Know

Large banks generally have stricter requirements, making it harder to secure financing. Nevertheless, they can generally offer better prices, as well as you'll understand that you are borrowing from a trusted resource. Little financial institutions might be more willing to offer to organizations in their hometown because they understand the company and also the business proprietor.As well as, it can be demanding to take into consideration just how tough as well as prolonged the payment of these finances can come to be. No person intends to accumulate organization financial obligation. If you beware about dedicating to a bank loan, you do have some business financing choices that are a bit much easier to safeguard (and also sometimes a lot more affordable).

All About Paypal Business Loan

You also have the versatility to obtain when you need from the permission and also prepay when you have surplus funds. Right here, you pay interest just on the quantity made use of. Apart from these groups of business fundings, we provide customised finances to experts such as fundings for businesswomen, hired accountants and medical professionals. PayPal Business Loan.

All About Paypal Business Loan

The fast response is "Extremely essential". When it comes to local business borrowing, proprietors and also their firms are viewed as one-and- the- same. Tiny service owners normally put in a great deal of influence over their business so lenders placed a heavy focus on the proprietor's debt profile. The better your credit score history and credit rating (FICO), the much better Recommended Site the possibilities you will certainly get a car loan; as well as, most likely on far better terms.Report this wiki page